Strategic rationale

We have looked very carefully at who we might merge with. It is critical for us to balance the benefits of consolidation against the need for real competition, which is important for our clients, and necessary to maintain checks and balances amongst competing firms.

The proposed merger will engender greater resilience, support investment in the areas that matter most to clients and will assist in the retention and attraction of key talent. Our clients will also have sustained future access to a larger, market-leading firm with greater bench strength and an aligned approach to client service.

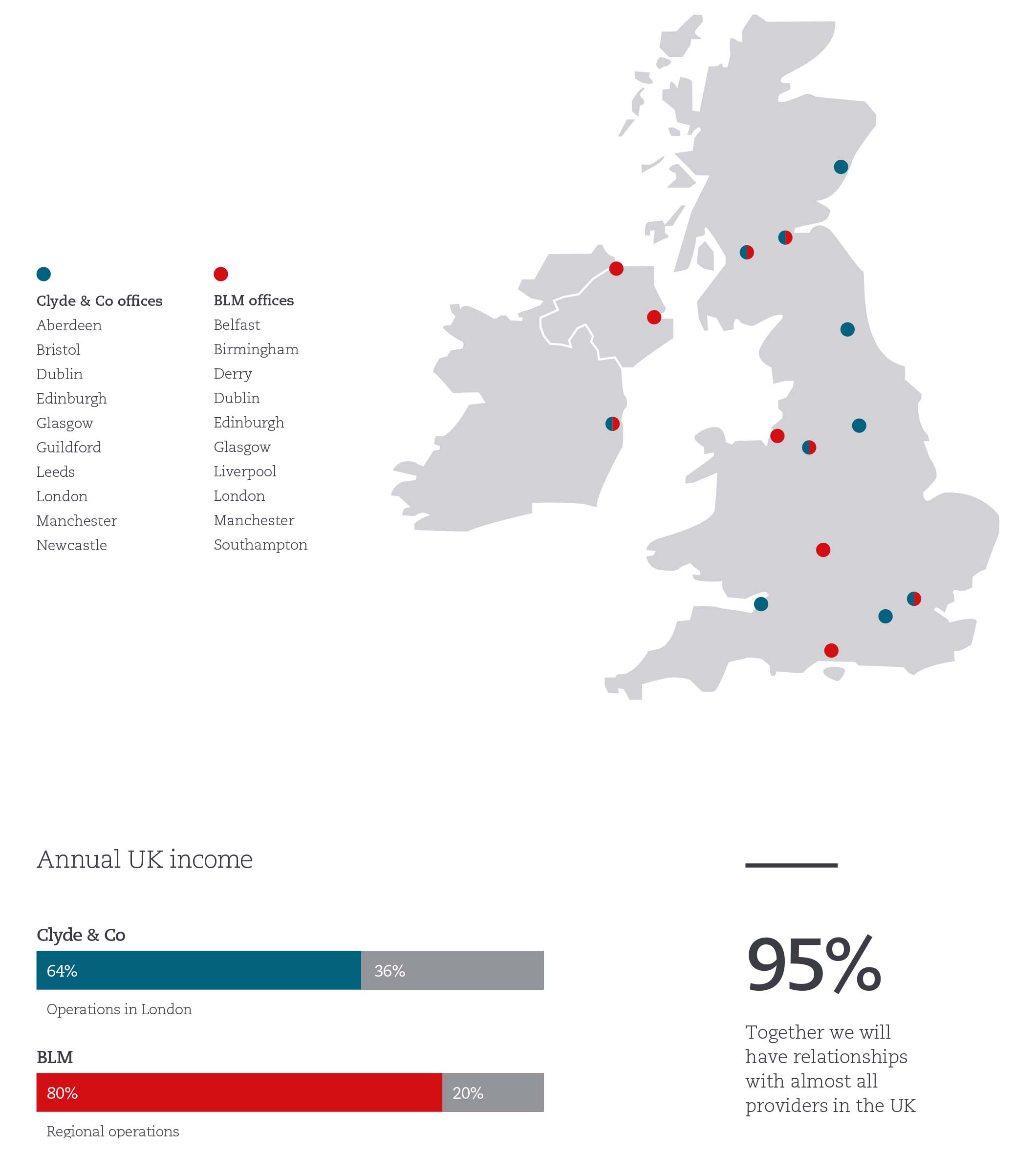

Clients have been increasingly looking for national, full service firms with regional operations, and this merger is in direct response to those needs. We will fill the respective gaps in each other’s client relationships and provide our clients with greatly increased presence in Ireland and Scotland, and in various centres of business across the UK.

It is critical for us to combine with a firm that reflects our own values and culture. A clear ESG agenda, a commitment to diversity and inclusivity, and a focus on client relationships will be at the centre of this combined firm. We will continue to seek ways to pursue greener, sustainable business practices, and ensure that we are promoting a diverse and inclusive workforce. In short, this merger will create an enduring firm with a clear commitment to our clients, our people and the world around us.