报告简介

产品

2023年8月10日

作者:

主题

Regulatory movement

下载1. Introduction

This report, researched and written by our global Corporate and Advisory team, explores the current risk landscape across numerous markets, and sets out our thoughts on what the future holds for the industry. Through the report, our experts also provide insight into the opportunities that can arise for our clients when we help them navigate those risks successfully.

Despite a continuing hardening market in many lines of business, the growth outlook for insurance businesses remains uncertain in the face of continuing geopolitical uncertainty and economic volatility.

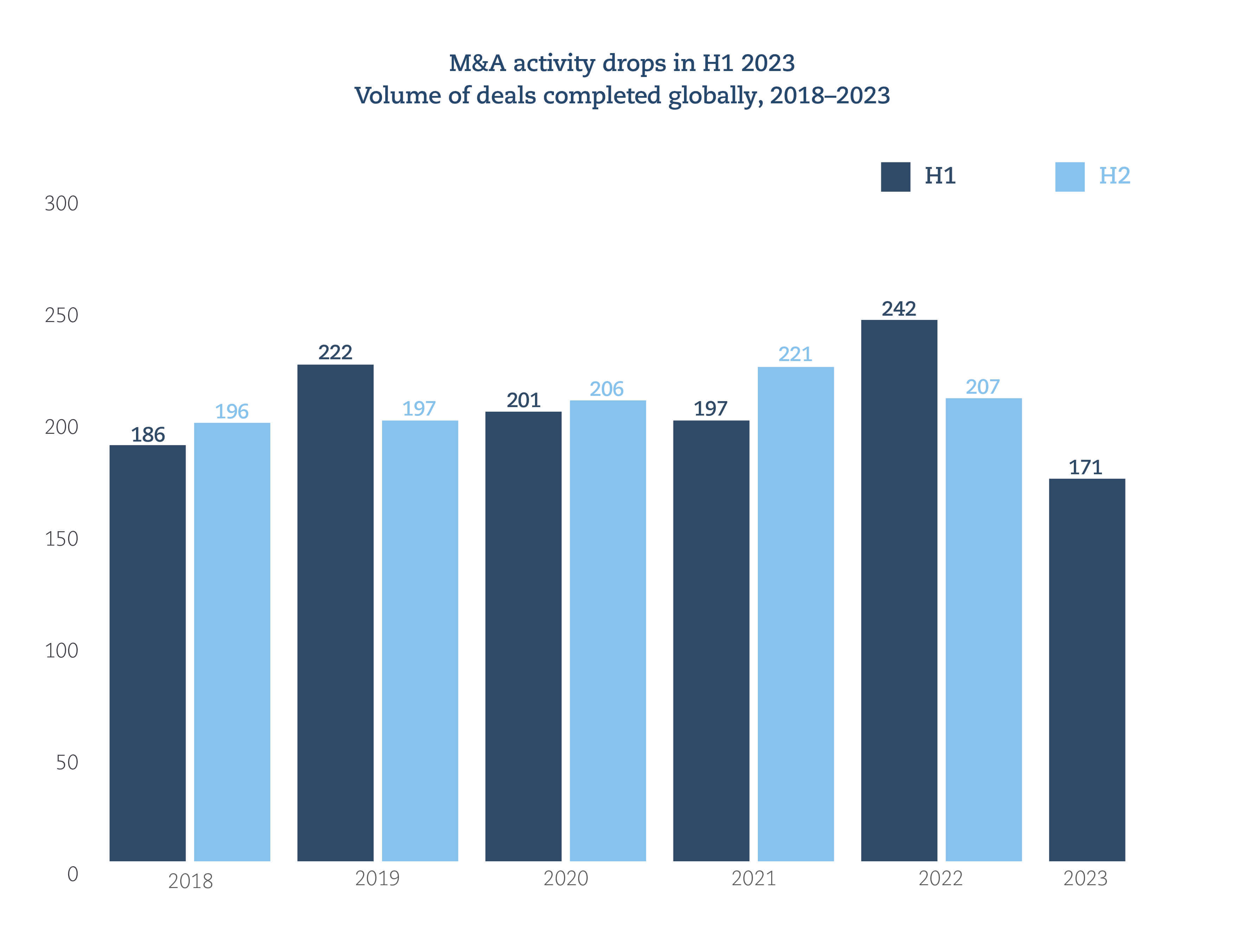

Given that growth in M&A activity typically lags behind improvements in underlying market conditions by anywhere from eight to 12 months, these developments are unsurprising. However, we anticipate that the volume of transactions will start to rise again towards the end of 2023 as insurance businesses acclimatise to the new operating environment, with the broker segment leading the way. There are certainly opportunities for savvy businesses able to respond rapidly to a positive shift in markets.

The lull in insurer M&A will be short-lived. Despite ongoing geopolitical and economic uncertainty, insurance businesses are adopting a ‘Keep Calm and Carry On’ approach. Carriers are less dependent on bank financing for strategic transactions as they are restricted to leveraging a smaller proportion of the transaction anyway. With insurers typically balance sheet-heavy at present, the break in carrier M&A activity is likely to be over. Meanwhile, private equity capital is returning to the market for broker deals.

Cyber continues to rise up the leaderboard, both as a growth opportunity for carriers and a risk management concern.

The potential impact of cyber exposures on deal-making is a growing focus for M&A deal-makers. Anecdotally, many acquirors have revealed that due diligence around cyber risks of target companies has risen from a top ten to a top five concern when considering potential acquisitions.

The uptake of cyber insurance in the MEA region is still fairly limited. As a result, there's a huge governmental focus on promoting preventative measures available to businesses and an education drive by brokers to address the lack of understanding around what cyber insurance can do. We are at a turning point in terms of changes in the local laws and regulations which will have a significant impact on the risk landscape – including the introduction of stringent notification requirements in relation to personal data breaches – resulting in greater interest in and need for cyber insurance.

Olivia Darlington, Partner, Dubai

Regulatory activity across the globe is having a two-fold impact on growth, with enforcement activities expected to put the brakes on some insurance activity due to the increased cost of doing business, while new legislation in other territories is helping to drive new business opportunities through the acquisition of companies, business units, and legacy portfolios.

ASIC has commenced legal proceedings in a small number of cases under the unfair contract terms regime and penalties will also be introduced from November. The regime is designed to protect individuals and small businesses who are subject to standard form insurance contracts they can't negotiate. There's nervousness about how the litigation will play out, the potential administrative cost to insurers of changing wordings and the potential penalties if they get it wrong.

Avryl Lattin, Partner, Sydney

The insurtech boom of recent years may have died down in some territories, but in other markets appetite is strong for investment in these businesses.

Many startups have chosen Chile as a regional hub and there are interesting growth opportunities here for insurtechs. Once insurtechs generate sufficient interest to get initial financing from local banks and companies, the next funding round will see them looking to the US, where there is tremendous interest in investing in Latin America.

Felipe Hoetz, Partner, Santiago

The distribution space is experiencing a great deal of activity currently, as both brokers and insurers pursue alternative opportunities for growth.

MGA partnerships are proving to be popular in many regions, despite speculation that the insurance market might have reached ‘peak MGA’. The market is growing substantially in both the UK and US, with some continuing growth also seen in Europe.

Regulation of retail insurance business written by UK branch offices is becoming more onerous, particularly for new companies. With carriers expected to retain at least 50% of the business, insurers who previously reinsured 80-90% of their line are now facing dramatically increased capitalisation, making the cost of doing business too expensive for some.

Ivor Edwards, Partner, London

For more information on the MGA market, click here to read our opinion report

The distribution space is experiencing a great deal of activity currently, as both brokers and insurers pursue alternative opportunities for growth.

Artificial intelligence (AI) is the topic du jour, but the lack of substantive regulations governing its use means that while many insurance businesses are developing AI tools, most are at a beta-testing stage rather than being deployed as operational solutions.

As the recent experience of some in the legal profession has shown, insurance businesses need to be cautious in their approach to AI, both in deploying the technology and insuring professionals who are making use of AI platforms.

There's acknowledgement from governments and the insurance industry of the potential for transformation within society that artificial intelligence can bring, and high level policies geared towards allowing and encouraging its use. There is less immediate activity around regulatory controls, but they will inevitably have to come.

Dino Wilkinson, Partner, Abu Dhabi

结束