Regulatory movement | 保险和再保险

Insurance Growth Report 2024 podcast series - Episode 1: Exploring UK & Europe’s M&A and regulatory

1. Introduction

As businesses continue to face geopolitical and macroeconomic challenges, their insurers will need a clear strategy for navigating the complex risk landscape and shifting commercial environment. This year’s Insurance Growth Report highlights M&A trends in 2023 and assesses the opportunities for organic growth ahead in a climate of uncertainty.

With 2024 set to be a bumper election year, political uncertainty is likely to be giving some business leaders sleepless nights.

Inflation continues to dog the global economy and with expectations of central bank interest rate cuts pushed back to later this year in key markets such as the UK, the US and the Eurozone, the cost of borrowing to fund M&A is likely to restrict activity for at least for the first half of this year.

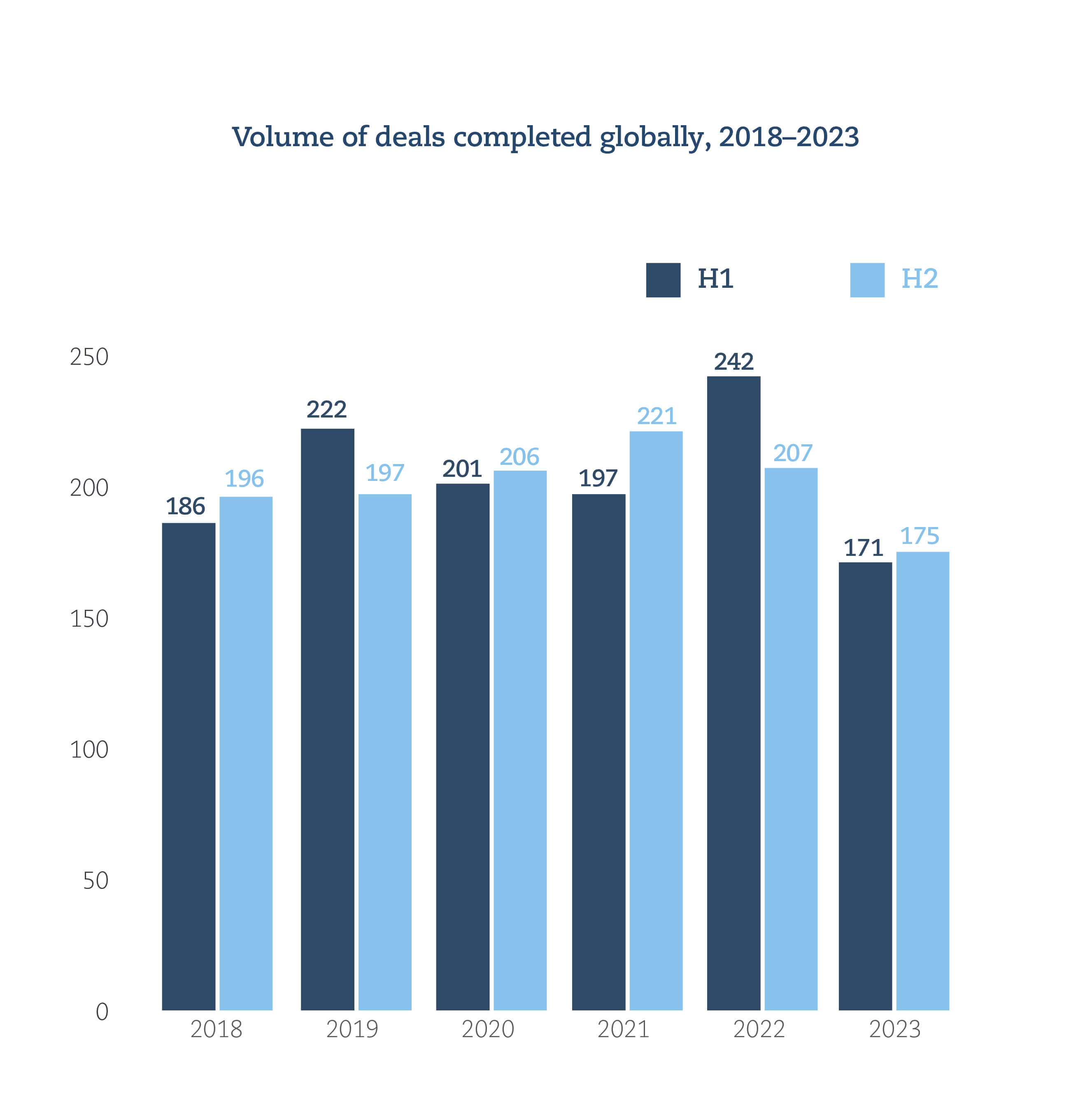

In 2023, the full year volume of deals globally hit a ten year low, although activity strengthened in the second half of the year. Private equity backing for deals may be harder to find while interest rates remain high, with those carriers who are capital rich due to prior divestments or careful reserving more likely to move on deals in the coming year.

产品

2024年2月26日

作者:

主题

Regulatory movement

产品

2024年2月26日

作者:

主题

Regulatory movement

Despite a year-on-year plunge in M&A activity across all regions, the 23% uplift in deals in Europe from H1 to H2 could indicate returning appetite for acquisitions in the region.

International carriers and MGAs who previously withdrew primary capacity from other regions are now looking to deploy their capital elsewhere.

There’s also strong appetite among would-be acquirors for buying up both carriers and books of business in the embedded insurance and affinity lines space. Global carriers who are seeing disappointing margins in commercial business are looking for reliable cashflow from the personal lines segment.

With an exemption in Kenya’s insurance regulations whereby foreign insurers can acquire 100% of a locally registered underwriter, we are seeing either partial or full acquisitions by international players.

Jared Kangwana, Partner, Nairobi

The uncertainty that accompanies the sheer volume of elections this year could impact insurers’ willingness to deploy capital in some markets. The outcome of the US elections in particular is likely to be closely followed, not least for the potential impact on Asian business that a return to more fractious US-China relations could bring.

A more pressing concern for businesses, however, is the impact of regional conflicts: the Russia-Ukraine war, the Israel-Hamas conflict, growing tensions with Iran and attacks by Houthi rebels in the Red Sea.

Conflict creates opportunity as well as challenges for the insurance sector, however, and Middle East carriers in particular are seeing increased appetite for coverage of war and political violence risks.

Alongside the inevitable delays and additional costs that are resulting from ongoing conflict in the Red Sea, the situation is also creating growth opportunities for local insurers in the GCC region. We are seeing a significant uptake on some of the available coverages with respect to war and political violence risks.

Peter Hodgins, Partner, Dubai

While the immediate impact of artificial intelligence (AI) on the insurance industry has perhaps been over-hyped, most international carriers are thought to be exploring its potential in areas such as improved data mining, automated underwriting for selected business lines and automatic processing of volume claims.

However, few are willing to commit to significant investment before AI solutions have been fully road-tested and regulatory frameworks established in key markets.

The revolution in digital assets and the use of cryptocurrencies presents a significant growth opportunity for insurers, with a range of coverages already being written to cover the risks of trading in digital assets.

Digital assets are on a very fast trajectory globally and we're seeing great demand for those assets. On the commercial side it presents a massive opportunity for insurers and, indeed, some major Lloyd's insurers are starting to underwrite D&O, corporate crime, and professional indemnity risks, on behalf of asset managers who are advising clients on diversifying their portfolios with exposure to this asset class.

Liam Hennessy, Partner, Brisbane

With cyber fraud, ransomware and data theft incidents showing little signs of abating, coverage for cyber risks continues to see significant growth in multiple territories across Europe, the MEA region and the Americas, with movement of both claims and underwriting talent between companies.

Embedded insurance is taking off not only as an acquisition strategy but also as an organic growth opportunity in some territories (particularly Australia and Italy) in connection with flight and hotel bookings and retail purchases.

However, carriers face challenges from the impact of 2023 catastrophe events, affecting both the affordability of property coverages in some territories and the cost of writing the business for carriers, some of whom have pulled out of writing property catastrophe business altogether.

We are now seeing massive growth in cyber insurance and a huge increase in W&I products in Italy and France. Previously, policies for both risks were not very popular, possibly because customers didn’t know about or understood the products. With a major increase in cyber threats, all insurers are investing in this line, while around half of all M&A transactions in Italy involve the purchase of W&I coverage.

Leonardo Giani, Partner, Milan

In Hong Kong, the Insurance Authority’s risk-based capital regime which comes into force this year is expected to make insurance business a more capital-intensive undertaking for small and medium-sized entities.

Meanwhile, the GCC region has seen an uptick in enforcement activity in the UAE and the Kingdom of Saudi Arabia (KSA). KSA has a new specialist insurance regulator and an overhaul of insurance regulations is expected later this year.

Climate change regulations continue to create challenges for insurers with portfolios that include carbon-intensive industries. In Australia, climate change litigation is expected to expand in 2024, with companies likely to more exposed to accusations of greenwashing.

Spot exchange-traded funds (ETFs) have been approved in the US by the SEC; the EU’s MiCA framework for digital assets is due to incept shortly; and ETFs in Hong Kong and Australia are expected to come online in the next couple of months, opening up opportunities for insurers of asset management firms involved with digital assets.

Chile’s Financial Market Commission recently published a General Rule for financial services regulation under the new Fintech Law, and we expect additional regulations in coming months, including one for parametric insurance. This is timely, as parametric products have recently been put to the test with claims brought by Chile’s two biggest forestry companies following last year’s wildfire losses.

Felipe Hoetz, Partner, Santiago

Continuing high interest rates will also impact the cost of debt funding for acquisitions and contribute to increased claims costs and higher operational costs.

But while optimism that 2023 would be another bumper year for M&A fell off a cliff by mid-year, reaching a 10-year low by year-end, there are signs that growth through acquisition could return this year.

Macroeconomic factors will continue to play a significant role in the insurance sector’s ability to achieve growth in 2024. With financial markets potentially looking more volatile this year, growth in carrier’s investment portfolios is by no means certain, despite higher interest rates.

结束