Middle East

2022 was a bumper year for the Middle East with the World Cup in Qatar, the continued announcement of giga-projects in Saudi Arabia and the post-COVID rebound of international tourism in the UAE.

Strong oil prices in the first half of 2022 boosted state coffers and enabled GCC governments to forge ahead with investments in strategic sectors and projects which are expected to keep the construction industry alive and booming in the years to come.

Following the success of the World Cup, Qatar is engaged in a massive demobilization effort in respect of its stadiums built to host the cup with some of them being packaged up and shipped around the world.

Saudi Arabia pushed ahead with contracts on the various packages of its NEOM project while announcing to global acclaim a new linear city known as “The Line”; a 170 kilometre long, 200 metre wide city with no roads, cars or emissions, running on 100% renewable energy. These projects are added to the large number of existing mega-projects currently under construction in the Kingdom.

The UAE saw sustained growth in its real estate sector following the success of the World Expo, the influx of expatriates following the easing of COVID 19 travel restrictions and the influx of immigrants escaping the destabilizing effects of the Russian war. There is a large pipeline of residential projects to be delivered in the coming years. In the commercial space, strong business conditions and limited office spaces resulted in peak commercial rental prices.

There remains a strong green hydrogen and renewable energy focus within the Middle East, which does not look set to abate anytime soon. Nonetheless, despite the GCC’s ambitious targets for diversification from its customary exploitation of hydrocarbons, events in Ukraine and Europe’s energy crisis have triggered a surge in regional gas production for export.

Legislative Developments

Legislative change continues apace in the region.

Saudi Arabia announced its Regional Headquarters Programme, pursuant to which companies who wish to contract with KSA government entities must have their regional headquarters in KSA. This will affect most, if not all, international companies and contractors doing business in KSA, including construction companies engaged on government projects.

The UAE announced a raft of changes including:

- the commencement of company tax which will come into force on 1 June 2023

- a new Commercial Code which came into force on 2 January 2023, which includes a reduction to the limitation period for commencing claims from 10 to 5 years

In the construction arbitration space, the Dubai construction arbitration sector is continuing to deal with the new landscape associated with the Dubai International Arbitration Centre’s absorption of the DIFC Arbitration Centre. In addition:

- DIAC published new arbitration rules which came into force on 21 March 2023

- a new Civil Procedure Law came into force on 2 January 2023

- a new Evidence in Civil and Commercial Transactions law came into force on 2 January 2023.

Challenges, opportunities and predictions

Looking ahead, we can expect ongoing continued growth in the construction sector as national governments continue to announce mega and giga-projects, attracting construction professionals and companies from around the globe. Whilst for the foreseeable future Saudi Arabia will remain the most valuable market in respect of planned projects pipeline, the considerable activity levels throughout the GCC across many sectors will cement the Middle East’s place among the most important construction economies in the world.

There are ongoing challenges with global inflationary forces affecting commodity prices and impacting contractors’ abilities to procure materials at sustainable prices.

We can expect ongoing developments in the regulatory framework of the different jurisdictions in the region, as national governments continue their march towards opening up their economies to the world.

Click here to go back to the top of the page

South Africa

In this review we take a look back at the challenges and opportunities in the South African construction sector during 2022. We also provide a brief review of how these challenges and opportunities may affect the construction sector in 2023.

Challenges And Opportunities

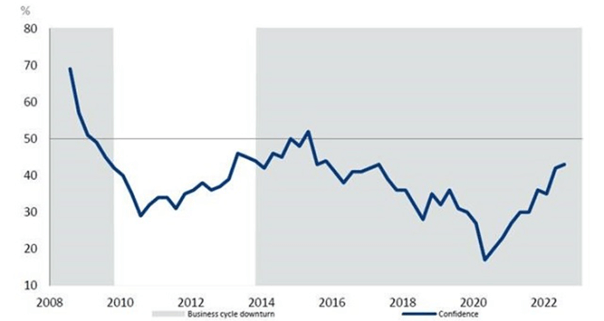

The past year has seen a continued recovery in the South African construction sector, albeit at a slow pace. The construction sector was negatively impacted by the economic slowdown in South Africa during the period from 2017 to 2019. More recently, the construction sector was negatively impacted by the Covid-19 pandemic as well as the uncertainty brought on by load-shedding throughout 2022. By mid-2020 however, the construction sector started to recover, and by the third quarter of 2022 has seen a continuing strengthening of the construction sector as a whole. It is hopefully an indicator that better days lie ahead. A further positive indicator is that profitability of the construction sector is at its highest since 2018. The construction sector has improved significantly but there is still a long way to go. The graph hereunder from the Construction Industry Development Board (CIDB) show the Business Conditions Survey up until the third quarter of 2022. [1]

Even though the construction sector is showing signs of recovery, the escalating load-shedding is having a detrimental effect on the South African economy. The National Treasury have downwardly revised its growth forecast for 2022 from 2.1% to 1.9%. Increasing load-shedding is compromising an already fragile and recovering economy, which warrants the urgent implementation of energy sector reforms announced by President Cyril Ramaphosa earlier this year. The interventions would add 14GW of power to the grid within two years. Currently, there is a generation capacity of 4GW and 6GW. [2]

The uncertainty bought about by load-shedding, does, however, present opportunities in the form of renewable energy projects and IPPs. South Africa has been on a major push towards renewable energy as not only the national power utility fails to meet the people’s energy needs, but the global community also encourages a shift away from fossil fuel reliance. In July 2022, the president announced the unlocking of approximately $8.5 billion (R140 billion) worth of green energy investment opportunities for the country. The money is pledged from the UK, US, Germany, France and the EU. Ramaphosa said the framework advocates for a massive expansion of renewable energy, battery storage, new energy vehicles, green minerals and the hydrogen economy. The biggest of these projects are the ACWA solar power plant in the Northern Cape, costing R11.6 billion and three solar projects by Scatec in the Northern Cape valued at $1 billion (R16.4 billion at the time) [3]

Predictions

Our predictions for 2023 are that with the impact of load-shedding, the renewable energy projects will be implemented on an urgent basis. This will hopefully positively impact the construction sector which will benefit from new projects. However, continued load-shedding in 2023 will, unfortunately, also continue to have a negative impact on the construction sector.

Click here to go back to the top of the page

Sub Saharan Africa

Trends in African Energy Projects

The Sub-Saharan Africa energy sector is vibrant with projects aimed at increasing and securing capacity demanded by greater urbanisation, higher living standards and a fast growing population - predicted to double to 2.5 billion by 2050. Recent reports on the Sub-Saharan African market show that energy projects have consistently made up a large proportion of the active projects across the wider market and, in 2021, Deloitte estimated that the sector represented 20% of all construction projects in Africa.

The Ukraine war has a notable effect, with international investors reviewing their risk analysis of the region, and governments seeking to reduce or remove their reliance on energy imports from Russia. The war has triggered sharp price-rises for energy, at least in the short term, causing a re-assessment of projects which were previously unviable or seen as having low returns, now becoming more attractive to investors. This will propel energy projects which provide for energy extraction and exportation.

Highlights include:

- Kenya - the Kipevu Oil Terminal in Mombasa will facilitate the import and export of petrochemicals in East Africa.

- Ethiopia - new clean energy projects, which in addition to a number of proposed wind and solar projects includes commissioning the Grand Ethiopian Renaissance Dam.

- Tanzania - the East Africa Crude Oil Pipeline, the proposed new USD 30bn Likong’o-Mchinga LNG plant and hydroelectric projects such as Steigler’s Hydroelectric Plant.

- Ghana – the proposal a nuclear power plant in Ashanti, currently in the planning and feasibility phase, in addition to an energy from waste plant that is in the planning phase.

Oil & Gas

West Africa has long been a major producer of oil and gas, but Southern and Eastern Africa have seen an upsurge in the development of new oil and gas projects in recent years, notably the new oil pipeline through Uganda and Tanzania, known as the East Africa Crude Oil Pipeline, and the well documented major LNG project in Mozambique. Mordor Intelligence assess that the East Africa upstream oil and gas industry is expected to grow at a compound annual rate of more than 3% for the period until 2025 which, given global trends, is significant growth.

The announcement of such projects has increased confidence in the sector across Sub-Saharan Africa which, together with the extremely high price of oil and gas on the commodities market, has resulted in further exploration being carried out, notably off the East African coast, with the new USD 30 billion LNG project in Tanzania due to commence in 2025, which will be the biggest LNG project on the continent.

The sector is expected to grow significantly in the short term, however the medium terms prospects are more uncertain, particularly as African governments may be unwilling to sanction such projects as they seek to reduce carbon emissions and may encounter difficulties in financing and insuring such projects.

Climate Change

Efforts to combat climate change have resulted in more carbon-neutral projects being developed than ever before in Sub-Saharan Africa.

The nuclear sector has historically been undeveloped but there are signs of change. Kenya is planning a USD 5 billion 2,700 MW nuclear power plant in Tana River County, which will have an initial capacity once operational of 1,000 MW with further MW to come online in future years. This would be a major development for the nuclear industry in Sub-Saharan Africa as, currently, South Africa is the only country with a functioning nuclear power plant (Koeberg NPS). Whilst the Kenyan project is not expected to enter its construction phase until 2030, its announcement may encourage other Sub-Saharan African countries to follow suit and develop projects of their own, particularly given that nuclear projects produce cleaner energy than traditional fossil fuel sources.

The issue however remains about the cost of developing and operating a nuclear power plant which may be prohibitive in many jurisdictions, although financing such projects is likely to become easier than financing traditional energy projects as time progresses.

Renewable energy projects are in the ascendance, driven by efforts to combat climate change and developments in technology. South Africa’s ‘Just Transition Framework’ (May 2022) defines actions aimed at transitioning to a low-emission and climate-resilient economy, and which should result in substantial investment in renewable projects. This reinforces RSA’s Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP) that has led to substantial investment in solar and battery projects the Northern Cape province.

Sub-Saharan Africa also has an abundance of natural resources which make it an extremely attractive location for hydroelectric projects, such as the Grand Ethiopian Renaissance Dam and Stigler’s Dam in Tanzania, and solar projects, which have seen an increasing number of large-scale projects which contribute power to national grids, having previously been dominated by smaller scale projects, which were designed to provide power for specific buildings or settlements. For instance, the 188MW Biopio Project in Angola announced last year will be the largest in Sub-Saharan Africa. In addition, in mid-2022 South Africa announced the construction of three solar battery facilities with a combined capacity of 540 MW – one of the world’s largest solar and battery initiatives. Among these is the Redstone Concentrated Solar Power Project in Postmasburg, which is expected to achieve full commercial operation by October 2023.

A relatively new energy source in the context of Sub-Saharan Africa is offshore wind, with a number of coastal Sub-Saharan African countries having huge potential, including South Africa, Namibia, Mozambique, Tanzania, Angola and Cote d’Ivoire.

The Global Wind Energy Council has recently published a report on the installation of wind capacity globally and has commented on the substantial uptake in installation, predicting 469 GW of wind power will be installed in the next four to five years, but, Africa accounts for less than one percent of global installed wind capacity. The IFC commissioned a study in 2020 that showed that Africa has enough technical wind potential to satisfy its electricity demands 250 times over and it is expected that harnessing this power will be key to unlocking growth. Previously, the key stumbling block was the cost of the infrastructure, but this is now falling as economies of scale take effect in the marketplace, which should result in a number of offshore projects in Africa becoming financially viable. For example, there is a potential 600 MW project off the coast of Tanzania, and Mauritius is inviting invitations to tender to develop its offshore capabilities. South Africa is another country that has huge wind potential and an economy that is developed enough to take on more expensive projects and is expected to become a key market for offshore wind in the coming years. In July 2022 a 147 MW wind farm was added to RAS’s power grid and during September 2022 the South African Department of Mineral Resources and Energy engaged EDF Renewables to construct three onshore wind stations that will produce a combined 420 MW. Onshore wind projects are also expected to increase with Ethiopia, for example, investing in the Aisha 1 wind farm, with further similar projects planned.

Conclusion

In the short term, due to heightened energy prices in the global market and the resultant shift by European countries towards alternative sources of energy, there will be significant growth in all parts of the Sub-Saharan Africa energy sector.

However, in the medium to long term, as countries’ targets for reductions of carbon emissions start to kick in, we should see fewer new oil and gas projects with the focus shifting to nuclear and renewables projects. Given Sub-Saharan Africa’s wealth of hydro, wind and solar natural resources, exciting times lie ahead for the industry.

Click here to go back to the top of the page

Ethiopia

GDP growth in Ethiopia is projected to have fallen to 4.8% in 2022, but the macro-economic position is expected to bounce back with growth of 5.7% in 2023, driven by industry and private consumption and investment. Whilst key downside risks such as the conflict in northern Ethiopia, COVID-19 and the knock-on effects of the war in Ukraine remain, overall the medium-term growth outlook is positive.

The construction market in Ethiopia is projected to grow annually at rate of more than 8% between now and 2026, propelled by the country's 10-year development plan which includes infrastructure development and public-private partnerships. The transport sector is also seen as a driver for sustaining robust growth and transformation.

On 17 November 2022, the African Development Bank approved the 2023-2027 Country Strategy Paper for Ethiopia, which plans to support the development of quality, sustainable and climate-friendly infrastructure, with the aims of expanding agro-industrialization and value chains, improving connectivity and inclusion, diversifying production and facilitating structural transformation. In particular, support will focus on expanding the road network to improve linkages between production centres and markets domestically and across the region.

Chinese and Italian contractors have traditionally held dominant positions in the Ethiopian construction market and continue to be important players, however there are likely to be significant upcoming opportunities for other international contractors to participate in transportation, power and industrial projects.

Notable Developments

- In July 2021, Ethiopia introduced its 2021-2030 10-Year Plan for Transportation Infrastructure, which envisages investment of up to ETB3.2trn (USD60bn) in expanding the country's transportation infrastructure over the coming decade, including five new road transportation corridors to ports in neighbouring states, an 85% increase in the country's road network to 245,900 km, six new airports, six new passenger terminals and an increase in air passenger numbers from 10.2 million to 48 million by 2030.

- In September 2022, Ethiopia Electric Power (EEP) announced that it had awarded a USD178 million contract to Korean contractor Hyosung Corporation to construct 420km of new transmission lines and upgrade several transmission stations in the country's southern transmission grid, with the project expected to be completed within three years.

- In October 2022, South Sudan and Ethiopia agreed to revive construction works on two cross border highway projects, which will see a highways built between Pagak in western Ethiopia via Gambella to Palouge in South Sudan and between Dima in Ethiopia and Bor in South Sudan. The two governments have agreed to co-finance the projects, which would enable South Sudan to export oil via Ethiopia and the port of Djibouti.

- In October 2022, US charitable group Ethio-American Doctors Group awarded a contract to Chinese construction company China Civil Engineering Construction Corporation to construct a USD95 million hospital in Addis Ababa by end-2025.

- In 2022, Safaricom Ethiopia announced plans to invest heavily in data centres in Ethiopia.

Click here to go back to the top of the page

Tanzania

An overview of Tanzania over the last 12 months

With a budget allocation of TZS 41.48 trillion for the year 2022/2023, the country is ready to engage in a competitive and industrial economy by prioritising a number of significant construction projects. The magnitude of the growth is echoed in the global response whereby multiple sources have applauded the efforts done to ensure the country has supportive regulatory frameworks, macroeconomic fundamentals, and a vibrant financial market.

Based on a recent report published by Absa Africa Financial Markets Index 2022, which analyses countries based on six (6) elements that include market depth, access to foreign exchange, market transparency, tax and regulatory environment, involvement of local investors, macroeconomic opportunities and legality and enforceability of standard financial markets master agreements - Tanzania has done exceptionally well in five (5) out of six (6) which makes the country’s current status quo provide a conducive environment for locals and investors to engage in sustainable investments.

Major ongoing projects

Liquefied Natural Gas Project in Tanzania

The Liquefied Natural Gas (LNG) Project located in Kela Fishing Village, Li’kongo, Lindi Region in the Southern part of Tanzania is valued at USD 32.7 billion. The project aims to produce and sell LNG and domestic gas between 2030-2059.

The project is anticipated to trigger domestic investments, and Tanzania’s strategic location and Asia-Pacific’s move towards environmentally friendly energy resources gives the country an opportunity to become a major natural gas supplier to India, wider South-East Asia, and China. The project is expected to boost the country’s Gross Domestic Product by 6.5% - 7.5% which is estimated between USD 5 to 7 billion per year.

The project will be developed by a newly incorporated project company. The licensors/shareholders include Norway’s Equinor in partnership with ExxonMobil which will hold a 44% stake and will operate Block 2, and Britain’s Shell in partnership with Pavilion Energy which will hold a 44% stake and will operate Block 1 and 4. The Tanzanian Government through the Tanzania Petroleum Development Corporation (TPDC) has a 12% interest in the project.

Shell and Equinor signed a Memorandum of Understanding confirming the joint development of the project in 2021 and ratified a framework agreement with the Government of Tanzania (the GoT) in June 2022. The Host Government Agreement is yet to be finalised between the parties; however, optimism remains high as the GoT is firmly cooperating with the foreign investors to finalise the negotiations for the project.

The project will set a foundation for Sub-Saharan Africa to develop greener energy resources which reflect the pledges made by countries during the 2021 United Nations Climate Change Conference.

Moreover, according to a macroeconomy report on the LNG project published by Stanbic Bank Tanzania in 2022, an estimated 277,356 to 647,048 jobs will be created. The creation of new employment allows the economy to maintain a healthy economic growth.

The project is also aligned with the objectives set by Vision 2025 and the Third and final Five-Year National Development Plan (FYDP) which aims to create a competitive and industrial economy for human development which will increase efficiency and productivity in manufacturing by utilising the resources available in the country. Furthermore, the LNG will be a catalyst to the rise of Foreign Direct Investment (FDI) in Tanzania.

The East African Crude Oil Pipeline Project (the EACOP)

The EACOP will be deemed the world’s longest heated oil pipeline which will run from Hoima in Western Uganda to the port of Tanga in Tanzania once it is completed. The shareholders include TotalEnergies with 62%, Uganda and Tanzania with 15% each held by their countries’ national oil companies and China National Offshore Oil Corporation (CNOOC) with 8%.

So far the GoT and Uganda have signed an agreement on the pipeline’s construction and Host Government Agreement was ratified in April 2021. Another significant step was reached in February 2022 by TotalEnergies, CNOOC, Uganda National Oil Corporation and TPDC after finalising the final investment decision.

The construction of the project is expected to begin in early 2023 with EACOP currently procuring essential goods and services needed to support the capital-intensive phase.

The foreseeable prospects of this project to Tanzania is the potential it has to transform Tanga into an economic centre brought by an increase of business activities in the area.

Moreover, FDI is expected to rise up to 60% during the construction phase. The anticipated impact of FDI growth is economic stimulation, increase in employment, development of human capital and access to management expertise, skills, and technology which allows companies, investors and also the local community and economy to develop.

The impact of the EACOP will further assist Tanzania to reach its objectives of becoming a competitive and industrial economy for human development as well as transforming the country into a middle-income country by 2025.

Some key legislative updates

Update on the Mining Regulations [4]

In September 2022, the GoT issued the Mining (State Participation) Regulations of 2022 (the SPR 2022) which directly impact every mining company or person holding a Mining Licence or Special Mining Licence in Tanzania. The SPR 2022 revoke the previous Regulations of 2020 (the SPR 2020). Here are some of the key highlights of the SPR 2022:

- In negotiating the percentage of Free Carried Interest shares to be issued by the Government over and above 16%, the following must be taken into consideration:

- extent of Government development of the public infrastructure servicing the mining venture; or

- any specific infrastructure put in place by the Government which is intended to make the particular venture feasible.

Introduction of the Carbon Trading Regulations, 2022 [5]

In October 2022, the GoT issued the Environmental Management (Control and Management of Carbon Trading) Regulations of 2022 (the Carbon Trading Regulations). The Carbon Trading Regulations apply to all carbon trading projects in Mainland Tanzania and are the first piece of legislation on carbon trading in the country. While the Regulations are new and first of their kind to be passed by the Tanzanian Parliament they must, however, operate together with ratified international treaties and any other written laws applicable on carbon trading. Please note that the Carbon Trading Regulations are silent on whether carbon credits must be created in Tanzania, however, they allow for the credits to be traded outside Tanzania.

According to regulation 34 of the Carbon Trading Regulations there are various stakeholders who may incur various costs hence are entitled to benefits from the project. These include the proponent, owner of the property involved in the carbon trading project (the Managing Authority), Regulatory Authority and the Local Communities. Costs and benefit sharing schemes shall consider capital invested, roles and responsibilities of the project stakeholders.

For land based projects

- The Managing Authority shall be entitled to 61% of the gross revenue accrued from the sale of Certified Emission Reduction (CER), out of the 61% issued to the Managing Authority:

- 10% shall go to the National Environment Management Council (NEMC) in case the Managing Authority is under NEMC; and

- the remaining 51% shall be issued to the Village Government for community development and conservation activities.

- In case the Managing Authority is not under NEMC, 10% out of the 61% issued to it shall be used for community activities at the village level:

- 6% out of the 10% issued, shall be issued to adjacent villages;

- 4% shall be issued to Local Government Council for conservation activities; and

- the remaining 51% shall be issued to the Managing Authority.

- Out of the remaining 39%, the Proponent shall be required to pay 9% to the Designated National Authority (DNA) out of which, the DNA shall pay 2% to the National Environmental Trust Fund and 1% to the agency responsible for energy.

Therefore, a proponent for land based projects shall be entitled to 30% of the gross revenue accrued from the sale of CER and the Government shall be entitled to 70%.

In respect of other projects with high initial capital investments, costs and benefits sharing shall be determined and negotiated between the Managing Authority and the proponent. Please note that the DNA shall provide guidance in order to facilitate fair and equitable costs and benefit sharing arrangements for carbon trading projects in Tanzania.

What’s ahead in the new year

The hope is that the two major ongoing projects discussed above will successfully launch as expected and that Tanzania will continue to put in place supportive regulatory frameworks to encourage the implementation of more projects. For example, the next financial year expects to see the start of the construction of the Bagamoyo Port worth USD 10 billion. In terms of reforms to attract FDI, certain sectors including mining and energy are being prioritised. There has been a lot more push for energy projects that have struggled for years, like the LNG Project and the EACOP.

Click here to go back to the top of the page

[1] South African Construction industry breathes easier (crown.co.za)

[2] Load shedding is 'disastrous' for SA economy, says Godongwana | Business (news24.com)

[3] Here are some of the biggest renewable projects planned for South Africa – including Ramaphosa’s latest (businesstech.co.za)

[4] Please see link to our more detailed updater: https://www.clydeco.com/en/insights/2022/11/tanzania-the-carbon-trading-regulations-of-2022

[5] Please see link to our more detailed updater: https://www.clydeco.com/en/insights/2022/10/the-mining-state-participation-regulations-of-2022