Project Financing the Development of a Mine in Tanzania

Legal Framework of the Port and Shipping Sector in Tanzania

-

Étude de marché 3 juillet 2023 3 juillet 2023

-

Afrique

-

Droit maritime

Tanzania’s port and shipping sector plays a crucial role in facilitating international trade and promoting economic growth in the East and Southern Africa region. To ensure efficient operations and regulation, Tanzania has adopted a comprehensive legal framework which underpins the sector. In this month’s legal update, we review the legal framework of the port and shipping sector in Tanzania.

The Ports Act and the TPA

The Ports Act No. 17 of 2004 (the Ports Act) is the foundation of the regulation, development, and management of ports in Tanzania. Under this Act, the Tanzania Ports Authority (the TPA) was established as the principal body responsible for managing and delivering services at all ports in the country. The key elements of the Ports Act include:

- establishment of the TPA as a public corporation operating under the Ministry of Transportation. The TPA's primary role is to promote effective management and operations of sea and inland waterways ports;

- entrusting the TPA with various functions, including facilitating cargo and passenger services, developing and managing port infrastructure, ensuring port safety and security, and contracting with other entities to secure port services;

- regulation of port tariffs and charges, ensuring a fair and transparent pricing structure for port services;

- provisions on port development initiatives, including infrastructure and superstructure enhancements, to accommodate growing trade demands; and

- regulation of various port activities, including vessel traffic, cargo handling, customs procedures, and environmental protection.

Although the TPA has primary responsibility to manage ports, it may at its discretion delegate the provision of such services to another entity through entering into a contract. Section 12(d) of the Ports Act states that the TPA:

“Negotiate, enter into, lease, concession, operating contract, management contract, service contract or any other form of contractual arrangement with any person including a body corporate for the purpose of delegating powers of the Authority to the said person or body corporate to carry out such activities as provided in the contractual document”

This provision underpins the TPA’s ability to delegate its management function of a port to the private sector for example. The TPA will retain responsibility where it deems necessary and delegate where it deems an alternative arrangement is more appropriate.

The TPA will typically use a form of Concession Agreement or Lease Agreement in order to delegate such functions.

Key provisions of such agreements in Tanzania include:

- The TPA as ‘landlord’ with a private sector terminal operator undertaking services. In such cases, the asset/infrastructure already exists, therefore the private sector will simply work under a management services arrangement. Although, still a concession agreement, the EPC, construction element of a greenfield site will not be relevant.

- Depending on the type of asset/infrastructure, the agreement may include rehabilitation, dredging responsibility and other forms of substantive input from the private sector.

- The form of agreement typically has the authority (the TPA) transferring operating rights to a private sector entity, which then engages in an activity conditional on authority approval (the TPA) and subject to the terms of the contract.

- Specific port services such as terminal operations, harbour master (only partial private sector input) or nautical services granted.

- The TPA will generally retain responsibility for perimeter security of the concession / designated area. Private security operated by the private sector will be allowed around the cargo area within the concession / designated area.

- The TPA will retain customs control including the Tanzania Revenue Authority interface.

The significance of procurement rules

The Public Procurement Act (the PPA) and Public Procurement Regulations (the PP Regulations) define the term ‘procuring entity’ to mean a public body and any other body, or unit established and mandated by Government to carry out public functions. Additionally, the term public body or public authority is defined to include among other things, any body corporate or statutory body or authority established by Government, and any local government authority.

The TPA is a statutory authority and fits squarely within the definition of an entity which must comply with the public procurement laws. Therefore, when delegating its responsibility to the private sector, it is incumbent upon the TPA to adhere to all relevant procurement laws.

Generally, the TPA is required to apply a competitive tendering process in the procurement of goods, works, services, non-consultancy services or disposal by tender. The TPA as a procuring entity will be required to comply with other specific prescribed tendering methods set out in the PP Regulations (section 64(1) of the PPA).

Single-source procurement is allowed under the PPA and the PP Regulations. Therefore, the TPA, being a procuring authority, can apply single-source procurement instead of a competitive bidding process. The PP Regulations provide specific guidance on the circumstances that the tendering board of the procuring authority (in this case, the TPA) must approve the single sourcing of goods, services, or works (Regulation 159(1) of the PP Regulations);

- the tendering board may approve single sourcing, subject to various factors, including:

- an urgent need for the works or supplier, where there is insufficient time for a procuring entity to engage in tendering or any other method of procurement. This urgency must be unforeseen and not caused by the conduct of the procuring entity’s delay (Regulation 159(1)(b) and 161(1)(a) of the PP Regulations);

- only one particular contractor or supplier is reasonably expected to undertake the required works or supply the required goods or services (Regulation 161(1)(b) of the PP Regulations);

- the tender board assesses the viability of the single-source selection method in the context of the overall interests of the procuring entity and the project. The tender board is responsible for ensuring economy, efficiency and providing opportunities to all consultants to the extent possible (Regulation 257(1) of the PP Regulations); and

- the tender board is satisfied that single-source selection offers a clear advantage over the competition, especially in situations where rapid selection is essential, such as in emergency operations (Regulation 257(1) of the PP Regulations).

The TPA may undertake port related projects under a public private partnership (PPP) arrangement in accordance with the PPP legal regime (the PPP Act and the regulations made under it).

Section 15(1) of the PPP Act provides that all PPP projects under the PPP Act must be procured through an open and competitive bidding process. Additionally, section 15(2) of the PPP Act allows the Minister responsible for PPP to exempt the competitive bidding process for unsolicited PPP projects that meet certain prescribed criteria. Accordingly, the TPA would be able to procure an unsolicited PPP project without a competitive bidding process provided that the same has been approved by the Minister responsible for PPP.

However, the PPP Bill of 2023 aims to amend section 15 of the PPP Act to enable the Minister to exempt the competitive bidding process for solicited PPP projects that meet specific prescribed criteria (Section 9 of the PPP Bill). Upon the PPP Bill being assented into law, the TPA will be able to procure solicited projects without going through a competitive bidding process subject to the project meeting the prescribed criteria and subject to the Minister responsible for PPP exempting the project from being procured through a competitive bidding process. This information is only accurate at the time of writing this updater.

Ports in Tanzania

Tanzania Mainland has several ports, including major, minor, and lake ports. The principal trading port is Dar es Salaam, which serves as the primary gateway for international trade. Other major ports include Tanga and Mtwara, while smaller ports include Kilwa, Lindi, Mafia, Pangani, and Bagamoyo. There are also lake ports on Victoria, Tanganyika, and Nyasa, serving various coastal regions and landlocked countries.

|

Coastal ports |

Lake ports |

|

Principal port: Dar es Salaam |

Victoria: Mwanza, Bukoba, Kemondo Bay, Nansio, Musoma plus 25 minor ports |

|

Major ports: Tanga, Mtwara |

Tanganyika: Kigoma, Kasanga plus 23 minor ports |

|

Small ports: Kilwa, Lindi, Mafia, Pangani, Bagamoyo |

Nyasa: Itungi, Mbamba Bay plus 13 minor ports |

|

10 other minor ports |

Inland Container Depots (ICD)

Inland container depots, also known as dry ports, are storage facilities used for temporary storage of cargo and containers before their transportation to their final destinations. As an extension of seaports, these dry ports effectively relieve the seaports and reduce congestion when there is an accumulation of cargo volumes and insufficient space in the port area. Additionally, they provide essential infrastructural support to seaports by facilitating growing imports and exports, thereby contributing to the overall economic development of the country.

These depots play a vital role in reducing port congestion, streamlining consignments, and supporting the import-export trade.

Shipping Agents

Shipping agents are corporations or companies engaged in providing shipping agency services for seaports and inland waterways ports. These agents act as representatives of the principal (shipping line or vessel owner) and undertake various responsibilities, including:

- arranging ship arrivals and departures;

- coordinating port services, customs procedures, and other necessary arrangements;

- handling cargo and ship documentation services;

- assisting with crew matters, ship supplies, and repairs;

- providing transhipment services and container stuffing and de-stuffing services;

- facilitating cargo storage, warehousing, and clearing and forwarding services;

- promoting shipping services on behalf of ship owners, operators, or charterers; and

- handling financial transactions and collecting freight charges.

Clearing and Forwarding Agents

Section 3 of the Tanzania Shipping Agencies Act, 2017 defines clearing and forwarding as follows:

"the function of processing shipping documents for import or export cargo through ports, pipelines, airports, border-post customs control and port formalities and procedures for necessary approval by relevant authorities and includes arrangement of physical delivery of cargo to consignee or ship master."

Clearing and forwarding agents in Tanzania are agents tasked with handling all port and customs procedures on behalf of the consignee or recipient of the cargo upon its arrival at the destination port.

TASAC: The Regulator

In 2017, the Tanzania Shipping Agencies Corporation (TASAC) was established pursuant to the Tanzania Shipping Agencies Act No. 14 of 2017 (the TASAC Act), replacing the Surface and Marine Transport Regulatory Authority (SUMATRA). SUMATRA was withdrawn and its regulatory functions were transferred to two new regulatory bodies: TASAC for marine transport regulation; and the Land Transport Regulatory Authority of Tanzania (LATRA) for land transport regulation.

TASAC serves as the regulator of shipping agencies in Tanzania, responsible for licensing and registering shipping agents and cargo agents operating within the country. TASAC performs the following functions:

- acts as a shipping agent, arranging the arrival or departure of ships and providing port services;

- administers the Merchant Shipping Act of 2003, exercises port and flag state control, regulates marine services and safety equipment, coordinates search and rescue operations, and protects the marine environment; and

- establishes standards, regulates rates and charges for maritime transport services, issues licenses, monitors service providers and shipping lines, facilitates dispute resolution, and registers shippers, shipping agents, and clearing and forwarding agents.

TASAC collaborates closely with the Customs and Excise Department of the TRA to license shipping ICDs and clearing and forwarding agents

A key element of the TASAC Act is to prevent monopolies and to promote fair competition in the sector.

An example of this is contained at Section 13(3) of the TASAC Act which regulates shipping agents. It states:

“the Director General shall not issue a licence for shipping agency if the applicant is a ship owner, ship operator, charterer, dry port operator or clearing and forwarding agent.”

The challenge with this obligation is that modern ship operators, logistics companies and other private sector entities are moving towards a full consolidated end-to-end service. They have the scale and resources to provide this service. Recent global mergers have effectively seen the creation of full service end-to-end providers. This approach does not yet necessarily fit neatly into the Tanzanian legal framework which highly regulates the constituent parts of the value service chain. It is yet to be seen how the new approach adopted in international markets will work in Tanzania.

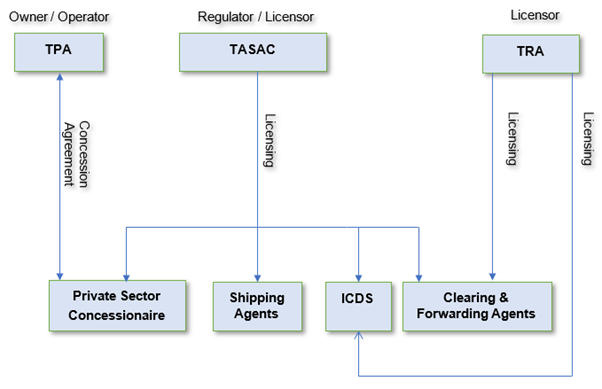

The Ports and Shipping Legal Structure

The above diagram illustrates the key stakeholders in the Tanzanian ports and shipping value chain. Please note that it is non-exhaustive, however it includes the key elements.

Tanzanian law and interaction with international Treaties

Tanzania is a signatory to the United Nations Convention on Law of the Sea (UNCLOS). Although UNCLOS is set to be reviewed and amended pursuant to ongoing talks, Tanzania's Exclusive Economic Zone (EEZ) extends from the shore to 200 nautical miles into the sea, covering an area of approximately 223,000 square kilometres.

The establishment of the EEZ is based on UNCLOS as incorporated into Tanzanian law through the Territorial Sea and Exclusive Economic Zone Act No. 3 of 1989. The EEZ grants Tanzania exclusive rights to explore and exploit natural resources within this area, including fisheries, oil, and gas. An example of such natural resources within the EEZ is the planned $40 billion offshore LNG Plant. Tanzania has proven natural gas reserves of approximately 57 trillion cubic feet, with approximately 49.5 trillion cubic feet of those reserves offshore in the Indian Ocean, however within Tanzania’s EEZ.

Please contact Peter Kasanda should you have any questions.

Fin