NSW EPA’s Climate Change Policy and Action Plan 2023-26: An insurance sector perspective

-

Étude de marché 23 février 2023 23 février 2023

-

Asie-Pacifique

-

Droit de l’environnement

Over the last three weeks, we have released a series of articles that look at the impacts on the NSW EPA's Policy and Action Plan. In this article, we consider the unique impacts and opportunities of the Policy and Action Plan on the insurance sector.

The Policy and Action Plan

In the August 2021 decision in Bushfire Survivors for Climate Action Incorporated v Environment Protection Authority[1], Preston CJ[2] found that the NSW Environment Protection Authority (EPA) has a duty to develop environmental quality objectives, guidelines and policies to ensure environment protection from climate change.[3] Preston CJ found that the EPA had not at the time fulfilled its statutory duty and ordered the EPA to develop environmental quality objectives, guidelines and policies to ensure environment protection from climate change.

On 20 January 2023, in fulfilment of that duty, the EPA released its first Climate Change Policy (Policy) and the associated Climate Change Action Plan 2023-2026 (Action Plan). Principally, the objectives of the Policy are to:

- maximise the economic, social and environmental wellbeing of NSW in the context of a changing climate and current and emerging international and national policy settings and actions to address climate change;

- reduce greenhouse gas emissions (GHG) in line with the NSW Government’s net zero targets, which are:

- a 50% reduction in emissions by 2030, compared to 2005 levels;

- a 70% reduction in emissions by 2035, compared to 2005 levels; and

- net zero emissions by 2050; and

- to make NSW more resilient and adapted to a changing climate.

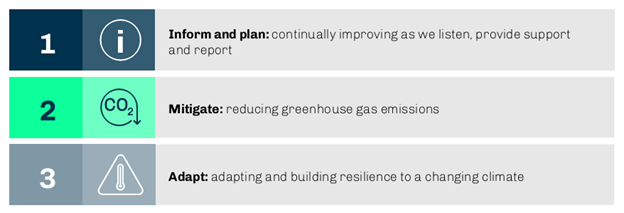

The EPA’s regulatory approach to achieving the Policy objectives is centered around three key pillars ‘Inform and plan', ‘Mitigate’ and ‘Adapt'.

[Image from the EPA, Climate Change Action Plan 2023-2026]

The Action Plan provides a framework for the delivery of the Policy’s objectives over the three year period from 2023-2026, and beyond, and demonstrates the EPA’s intention to take stronger regulatory action on climate change primarily focused on the reduction of GHG emissions by environment protection licence (EPL) holders.

We have released a series of articles that look at the impacts on the Policy and Action Plan on industry [see links at the end of this article]. In this article, we consider the unique impacts and opportunities of the Policy and Action Plan on the insurance sector. We also draw on the importance of the Policy and Action Plan for the insurance sectors goals as outlined in the Insurance Council of Australia’s Climate Change Roadmap released in November 2022 which presents a roadmap for the insurance sector to achieve net-zero emissions by 2050.

The EPA has identified 25 actions to deliver on the Policy, supported by key performance indicators and deliverables. Of note to the insurance sector are the following actions:

Actions for reducing GHG emissions and mitigating the effects of climate change

- The progressive implementation by EPL holders of climate change mitigation and adaption plans (CCMAPs). The EPA will require CCMAPs to be made publicly available on corporate websites of EPL holders to assist in transparency and accountability in the regulatory regime. Given the current trends in enforcement action nationally and globally, these CCMAPs heighten the risk of greenwashing claims, shareholder litigation, and climate change related litigation. Licence conditions may be used in EPLs to explicitly require mitigation and adaptation actions identified in CCMAPs to be implemented. It is intended that this action is rolled out within 24 months. CCMAPs will support the insurance sector’s efforts to assess and address climate risk on their books and to achieve Pillar 3 of the ICA’s Roadmap, which encourages net-zero emissions associated with insurance and reinsurance underwriting portfolios by 2050.

- Progressively requiring EPL holders to update pollution incident response management plans (PIRMPs) to consider climate-related risks. As part of this action, the EPA is to develop PIRMP guidelines to assist EPL holders in assessing climate-related risks. It is intended this action is rolled out within the 12 months.

- Developing GHG emission reduction targets and pathways for key regulated industry sectors. These targets will exist alongside the NSW Government emission reduction targets and provide targets for industries which will make emission reduction progress at different rates for different sectors. The purpose of industry-specific reduction targets is to assist in honing the EPA’s regulatory efforts and as the targets will apply to an industry collectively, they will not be enforceable against specific EPL holders. Rather, they will provide a “tailored and transparent” signal for each industry sector. The EPA also indicates that it might consider targets for an emission source, such as stationary energy (excluding electricity generation), that is relevant to many sectors as a means of focusing its regulatory efforts. The industry-specific advisory groups will play a role in guiding the setting of these reduction targets.

- Placing GHG emissions limits and other climate change related conditions on licences for key regulated industry sectors. The related conditions are expected to include conditions relating to monitoring, reporting and emissions estimation; performance requirements that would require implementation of performance in operations designed to reduce GHG emissions (such as use of low emissions equipment); and pollution reduction studies and programs. Any limits per conditions will be informed by industry-specific reduction targets. Emissions conditions could take the form of load limits or emission intensity limits and could be met, at least in part, using offsets.

Underwriters should carefully evaluate CCMAPs, PIRMPs and EPL licences in underwriting decisions and develop a best practice methodology to support that evaluation.

Actions for adaptation and resilience building

- Developing an agency adaptation and resilience delivery plan to guide how the EPA will deliver on its responsibilities under the NSW Climate Change Adaptation Strategy, including its regulatory responsibilities.

- Developing and implementing environmental resilience programs and initiatives to better respond to emergencies and disasters. This includes developing sector-based initiatives that will assist EPL holders build their own climate change resilience, with a primary focus on building resilience in the waste sector through the development of contingency waste capacity and overall climate preparedness.

Given the importance of resilience in de-risking insurance books, these actions will lead to some positive outcomes for the insurance sector in allowing it to better understand the risk profile of business in NSW, and have more information and transparency in developing new products and extending cover to climate affected businesses and people.

Objectively measuring risk profiles and capitalising on these opportunities will require insurers to critically assess the adaptive capacity and resilience of EPL holding insureds and insureds which operate in impacted industry sectors.

For example, this will require careful investigation and understanding by insurers of the quality of an insureds CCMAP, PIRMP and the ability of insureds to effectively monitor, manage and reduce GHG emissions within applicable limits. Further, implementation and oversight of the Action Plan by the EPA is likely to increase the level of regulatory intervention via investigations and the commencement of enforcement intervention and action. Together with increased exposure to greenwashing type claims, such enhanced regulatory focus has implications for insurers' exposures under liability and defence costs covers.

We therefore recommend that insurers consider the above implications and map these increased exposures against existing liability (in particular, EPL) policy wordings. Current wordings should be stress tested against hypothetical novel scenarios that may arise under the new regime to ensure that future coverage outcomes under the policies operate as intended.

Furthermore, as insurers begin to develop their own net-zero targets (in line with the guidance in the ICA’s Climate Change Roadmap) and climate related data from insureds becomes more readily available such as through the mechanisms proposed by the Action Plan, insurers open themselves up to risks relating to greenwashing claims, shareholder activism and derivative actions if its own operational activities are not evidence-based and are not aligned with its own net-zero targets. We therefore recommend insurers carefully consider and plan to maximise the utility of the EPA’s proposed actions on the insurance sectors net-zero journey.

Other articles in this series geared to industrial sector and EPL holders:

Pillar 1: Actions to Inform and plan

A copy of the Climate Change Policy and Climate Change Action Plan are available here

Clyde & Co remains committed to mapping and understanding climate change risk alongside a growing network of cross-sector experts and collaborators, to help our clients navigate the rapidly evolving risk landscape they face. If you would like to discuss the issues raised and how this may impact your business, please contact one of our authors. For more thought leadership articles on the climate change related topics, visit our Resilience Hub and our Climate Change Risk webpage.

Fin