À propos du rapport

Produit

4 octobre 2023

Écrit par:

Sujets

Réformes réglementaires

TéléchargerCliquez sur chaque termes pour accéder aux articles correspondants

1. Introduction

Following the launch of the first part of our Corporate risk radar report (previously known as Looking Glass), this second part explores two of the most pressing risk management challenges facing GCs and their boards – climate change and digital transformation.

Corporates are operating within an environment of considerable uncertainty. While immediate economic concerns have necessarily taken priority for many business leaders this year, the enduring threats (and opportunities) posed by climate change and digital transformation are still exercising the minds, attentions and resources of the 200 business leaders surveyed in our report.

As these areas evolve at pace, issues abound. For example, questions over how to regulate the previously unregulated – think generative AI, for example – and exactly what these regulations will mean for businesses are risks that increasingly climb the boardroom agenda.

So too does the prospect of emissions reduction targets and environmental impact mitigations which present liability risks that many GCs and boards feel unprepared for. And amidst all this, growing cyber threats remain a constant lookout alongside the considerable investments needed to guard against them.

Organisations are grappling with tensions between the short-term imperative to deal with the deteriorating economic outlook and the long-term mission to address climate change. Pressure to set and meet climate change targets is strong, but so is the need to manage costs and protect revenue without compromising profitability.

There is continued and consistent agreement across all respondent types – Board, GC, and C-Suite – that ESG, Regulation and Transition related climate risks will have the biggest impact over the next two to three years.

Reducing carbon emissions and establishing more sustainable operations remains high on the agenda of most organisations.

When it comes to climate-related risks, even if you’re following the regulations to the letter, you could still be discredited by activist NGOs. For example, buying carbon credits is being exposed as not ‘real’ actions towards net zero. So businesses – and regulators – need to get ahead of the curve."

Rachel Cropper-Mawer, Clyde & Co Partner, UK

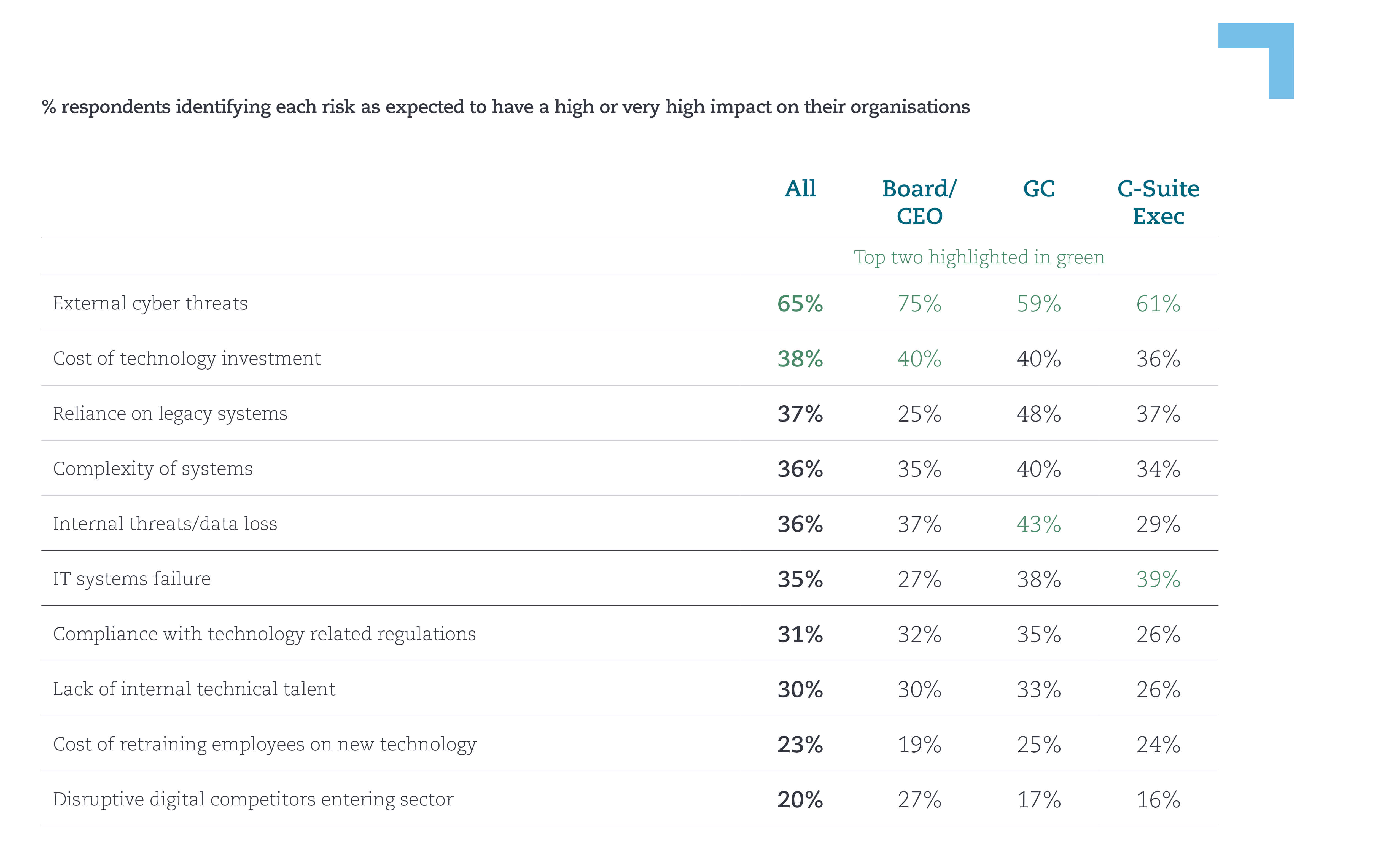

The main perceived tech risks are largely unchanged compared to the previous wave. Cyber threats remain the top technology risk to organisations, followed by cost of technology investment.

75% of board respondents say they are at high or very high risks of ‘external cyber threats’, and is rated as having the highest impact for GC (59%) and C-Suite exec (61%) respondents.

Incidents involving DOS attacks, ransomware or trojan viruses continue to be commonplace, and most respondents are taking an ‘it’s not if, it’s when’ outlook.

Cyber threats are by far the biggest digital risk. Investments in new technologies are being kicked down the road, but legacy systems are much easier to exploit. And insurance premiums are sky-high so some businesses might not get cover.

Thomas Choo, Clyde & Co Partner, APAC

One of the high-profile components of future technology investment is Artificial Intelligence (AI).

The rapid evolution of AI has forced regulators to move quickly, with more legislation such as the US AI Bill of Rights and the EU AI Act coming into place. Managing the regulatory aspects of internal and external AI operations will be a major challenge for business leaders, and particularly for GCs.

Everybody’s talking about generative AI: they’re looking at the opportunities but also worrying about what it means, where the data has come from, what are the rights and obligations around input data and who owns the outputs. There are divergent approaches from regulators and from companies and there’s a balance to be struck between embracing it and protecting it against harm.

Dino Wilkinson, Clyde & Co Partner, MEA

To understand how business leaders are addressing the global risk landscape, we have consulted over 200 Board Directors and CEOs, General Counsel (GCs) and other senior C-Suite executives from multiple sectors and across all global regions. In addition to the first two parts of the report, we will be issuing a final report which will explore the continuing evolution of the GC role.

Fin